Last Friday I received a very nice email from the Economist Intelligence Unit’s (EIU) Business Research group, letting me know about a new report they thought I’d find interesting. Called “The Search for Growth: Opportunities and risks for institutional investors“, it provides data and analysis from a March 2011 (I believe) survey of 800 (mostly financial) firms which asked for perceptions of growth prospects in different sectors and regions as well as an assessment of risks and opportunities for the next 12 months (pdf here). Having read it on the plane from London to Riyadh yesterday then used one of their charts in a presentation today, it’s worth a look if you’re interested in outlooks on global risks.

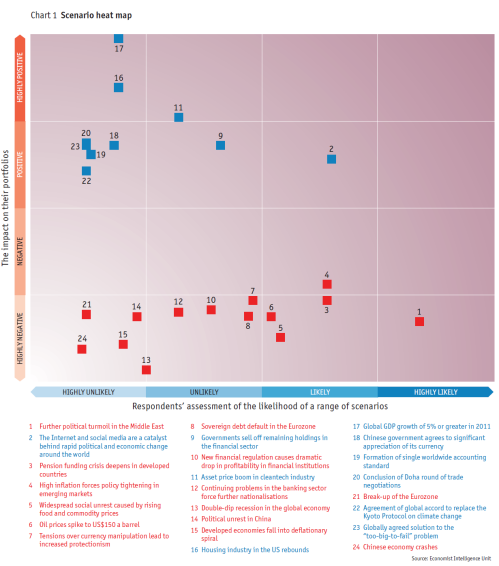

I can see why EIU thought I’d like it – it dovetails very nicely with the Forum’s Global Risks 2011, supporting our Global Risks Survey data with slightly more recent data. As with our work, EIU asked respondents (among other things) to assess the likelihood and impact of range of global uncertainties, then married that with expert interviews. Apart from taking 1 year rather than a 10 year outlook, what’s different in the EIU approach is that these are termed “scenarios” and, from what I can gather from the helpful appendix showing the results, were posed in two sets – the first set being clearly negative “scenarios” (e.g. Break-up of the Eurozone), and a second being rather more positive “scenarios” (e.g. Housing industry in the US rebounds). Thus, their impact axis, rather than being purely negative in cost terms (as the Forum’s is), goes from “Very positive” to “Very negative”. While the pedant scenario planner in me would rather think of these as fairly thinly described events rather than true scenarios, the use of positive events is a neat twist on the impact-likelihood matrix. As the most interesting chart doesn’t seem to be in html form on the EIU website, I’ve uploaded it here:

While I appreciate the survey and display innovation (and should add that the supporting analysis is solid) I wanted to put down a few reflections about the results which contributed to some the discussions here in Riyadh.

At first glance, the results shown in the chart above give the impression that investors are pessimistic or bearish, as it appears that the positive scenarios are, as a set, both less likely and less positive than the negative scenarios are likely and negative respectively. Only one positive scenario (The Internet and social media are a catalyst behind rapid political and economic change around the world) making it into “likely” territory, as opposed to five negative scenarios, four of which are “highly negative” for investors.

What can explain this? Of course it could be that people simply see negative scenarios as more likely and of greater impact than positive scenarios at this point in time, as various economic, social and political pressures create greater-than-normal systemic fragility and/or negativity in investors minds. However, it’s also possible that this distribution results from biases within the positive scenario set that was chosen – driven in turn by the fact that it is simply more difficult to come up with positive scenarios that sound reasonable than it is equivalent negative ones.

For example, while I personally love the cluster of global-governance related events in the top left (the result supports our analysis in Global Risks 2011 of the current state of multilateral decision-making), having a large proportion of positive scenarios as events that require coordinated action over longer time periods (such as Agreement of global accord to replace the Kyoto protocol on climate change), while having negative scenarios that are more general and distributed could be skewing the outlook somewhat. Could the survey have corrected for this by including intermediate steps along the way to a global accord, perhaps, which could be more reasonable in the time frame of the survey, yet still have positive impacts through market signalling?

Perhaps. But, to be fair, the report doesn’t make any claims about optimism or pessimism from the distribution of results in this chart. (In fact, the report is largely based on answers to questions not linked to this chart, with answers to other questions indicating a generally positive, if cautious, outlook globally.) And while part of me feels that there’s been a missed opportunity for the survey makers to think up a range of other possible positive events that would represent intermediate points of generalized opportunity, when I try myself, besides news of specific technological breakthroughs (cure for most types of cancer, amazingly efficient solar technology), I realize it’s far from simple to create such stepping stone scenarios. But the fascinating question for me in all these exercises is “what have we left out?”. For an entirely negative set, sometimes it’s a relief to stop thinking about quasi-black (charcoal?) swans. But I’m very much drawn to taking this question further in the case of white (double rainbow?) swans. Most scenario thinkers will agree that positive scenarios are the hardest to write, as they tend to smack of implausibility. And of course I realize that criticizing EIU’s choice of scenarios puts me in a glass house – our risk set is also open to criticism for not being MECE and levelled across categories too.

Second, I detect some interesting inconsistencies in the results that could be the result of packaging the survey questions into a “negative” group and a “positive” group (if that is indeed how the questions were asked – see pp32 to 32 of the pdf), with the divide creating artificial space between otherwise correlated scenarios. For example, the scenario The Internet and social media are a catalyst behind rapid political and economic change around the world is seen as likely and having a positive impact on investor’s portfolios. Yet, Further political turmoil in the Middle East, while similarly (although more) likely, is seen as having a highly negative impact on portfolios. Given the one year outlook and recent events in the MENA region (which have been, accurately or not, firmly linked to the Internet and social media, as Egyptian, Libyan, Tunisian and Syrian attempts to control these have shown), I would have thought that respondents would have seen these two scenarios as positively correlated, dragging down the perceived beneficial impact of the Internet and social media. An alternate explanation could be that respondents overwhelmingly associate these technologies with good things, though personally I would have predicted more negative associations with “rapid political and economic change”. Perhaps it is simply that the words “Internet” and “change” are far more positively viewed by respondents than “turmoil” and “Middle East”, and the result would hold even if if the scenarios were not sandwiched among other positive and negative scenarios respectively.

There is also an interesting tension between the perceived optimism of respondents regarding the Internet’s (typically leaderless and decentralized) power to have a positive impact via rapid political and economic change within a year’s time, and the perception that concerted efforts by multilateral institutions are very unlikely to achieve an equivalent impact over the same time period. This result is unlikely to be explained by the survey design. People simply must have more faith in the power of the iPad2 than the G2. Hmm.

In fact, it is the tension in this diagram and these results that makes it interesting, which brings me back to being in Saudi and why I’m writing this at all, having spent far longer than I normally would going through a report of this type.

Reflecting on these issues on the flight to Riyadh last night proved very useful. Early on in today’s workshop on Saudi Arabia’s evolving business environment, one of the participants made the point that it was important to look at investor perceptions of both the Middle East and Saudi to understand potential capital flows. Thanks to the Forum’s global risks matrices and systems diagrams (with their links to geopolitical risk) and the above chart, we had a lively and productive discussion about what distinguishes Saudi Arabia from the rest of the region. I won’t go into the ensuing debate, but I was very glad that I had spent some time thinking about how we perceive global risks and opportunities related to the region. And as most of the world’s organizations try to come to grips with these topics in a time of turbulence, I’m pleased that the Forum, EIU and many others are innovating in terms of how we identify and assess uncertainty using a combination of perception data, expert input and quantitative analysis. It’s possible to find flaws in every approach to assessing risk, but any approach that drives strategic conversations and dynamic debates is valuable.

Is it just me, or are the evaluations as a single blob misleading? As you hint at, number 2 is questionable. In the UK the Internet, social media and mobile phones facilitated a situation during 2000 where the government seriously misunderstood what was going on, with grave potential consequences. I know that in theory democratic governments should be able to cope, but in practice I doubt it. I would prefer to see vertical bars or perhaps multiple blobs per ‘scenario’.

It seems to me that the seemingly precise kind of heat map that you show must be suppressing the ‘risk proper’ and so not really helpful exept as a discussion point. In similar situations I have facilitated a discussion and got participants to mark where they think things should go, both before and after. If there is a big discrepancy from before to after that suggests communication topics. If there is still a big spread after that suggests further research / debate.

I have blogged at http://djmarsay.wordpress.com/2011/06/17/uncertainty-and-risk-heat-maps/ .

Regards.

By: djmarsay on June 17, 2011

at 12:26 pm

[…] ‘Managing Uncertainty’ blog draws attention to it and raises some interesting issues. Importantly, it notes that it […]

By: Uncertainty and risk ‘Heat Maps’ « djmarsay on October 22, 2011

at 5:26 pm